Lexicon Financial Group Weekly Update — January 15, 2025

“It is important for investors to understand what they do and don’t know. Learn to recognize that you cannot possibly know what is going to happen in the future, and any investment plan that is dependent on accurately forecasting where markets will be next year is doomed to failure.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

Looking Around

Another New Year. Another batch of resolutions and another batch of predictions, forecasts and prognostications from pundits and readers-of-tea-leaves.

We read a lot of forecasts from a lot of different sources. The only thing that people know for sure is that they don’t agree with each other completely, but there are often areas that they do agree. Whether the “consensus opinion” turns out to be right, depends on factors outside of our control, of course.

Most analysts in the United States (U.S.) are predicting solid returns for the S&P 500 in 2025. This comes after the S&P 500 jumped 23 per cent in 2024, following a 24 per cent increase in 2023. Some analysts contend that investors can look forward to another year of solid returns, albeit not at the same level enjoyed over the last two years.

UBS and RBC Capital Markets have set a price target for the S&P 500 at 6,600, which reflects an upside potential of about 11.5 per cent for the year. According to UBS chief investment officer Mark Haefele, this upside scenario would see lower taxes, deregulation, and trade deals, adding to a positive market narrative built on solid growth and continued investment in artificial intelligence. Bank of America is on the same page, but its analysts predict the S&P 500 will rise 12.6 per cent. BMO Capital Markets forecasts the S&P 500 will reach 6,700, reflecting a gain of 13.2 per cent. Evercore ISI (which was recognized as the number one firm in U.S. equity research for third year in a row, last year) has a similar take but one that is slightly more bullish – it expects the S&P 500 to jump almost 15 per cent and hit 6,800 by year-end with a possible pullback in early 2025.

Why the positive outlook? Well… deregulation, lower interest rates and proposed tax cuts by the incoming administration in the United States.

However, some analysts are not as optimistic. Analysts at Citi, Goldman Sachs, J.P. Morgan, and Morgan Stanley all forecast that the S&P 500 will rise to 6,500 and achieve nearly 10 per cent this year, which is slightly below other forecasts. Still bullish, but perhaps a bit cautious. (1)

In Canada, investment strategists expect the S&P/TSX Composite Index (TSX) to maintain its momentum of an 18 per cent jump in 2024, in 2025. This expectation rises above the threat of possible tariffs from Donald Trump’s incoming administration hanging over the Canadian economy like a fog in spring. The tariff threats made by Trump have resulted in a flurry of political action in Canada, as economists have become concerned about a possible recession. Furthermore, according to some of these strategists, rising corporate earnings and lower interest rates will help drive the TSX toward a record 28,000 points in 2025, which would mean another year of double-digit returns for the index. One of those making this call is Philip Petursson, chief investment strategist at IG Wealth Management, who said Canadian stocks have more reasonable valuations than U.S. equities, which gives them room to catch up.

The Bank of Canada (BoC) is expected to keep cutting interest rates, possibly to an overnight rate of 2.5 per cent by the middle of this year. Easier central bank policy, which provided a tailwind to technology and financial shares (making them the best performers of the TSX’s 11 major subgroups) in 2024, is expected to continue to do so in 2025. The Canadian dollar has been weak due to slower growth, lower interest rates and potential tariffs. This benefits the TSX because it has so many companies that have a sizable percentage of U.S. dollar earnings, which are worth more when converted back into Canadian dollars. For exporters, a lower Canadian dollar is a partial offset to tariffs. The wet blanket for all these positives is the implementation of the Trump tariffs. (2)

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

2025 Stock Market Outlook: Yahoo Finance

Wall Street ends sharply higher with assist from tech; investors eye Trump policies

If you have read our previous weekly updates, you know that although we may take forecasts into consideration, we take them with a pinch of salt. Why? According to the CXO Advisory Group, across all forecasts, accuracy was worse than the flip of a coin—on average, just under 47 per cent. Market movements are often dominated by surprises, such as the Covid pandemic, which, by definition, are unforecastable. The financial media tends to focus much of its attention on market forecasts by so-called gurus because they know it gets the investment public’s attention. Instead of focusing on forecasts, investors should focus on a well-thought-out investment plan and stick to it. (3)

The legendary World War Two U.S. General George S. Patton once said that if everyone is thinking alike, then somebody isn't thinking. The history of market forecasts is littered with examples of this type of thinking and we are committed to thinking differently in the face of herd thinking when it comes to managing your portfolio. That said, we have posted various outlooks that we have come across for you to read in our “Links To Help You Learn” section.

Our response to the markets continues to be constructing, managing, and rebalancing broadly diversified portfolios.

Looking Back

Last Friday, U.S. and Canadian stocks sold off, with the S&P 500 erasing its 2025 gains, after an upbeat American jobs report stoked fresh inflation fears and reinforced bets that the Federal Reserve (Fed) will be cautious in cutting interest rates this year.

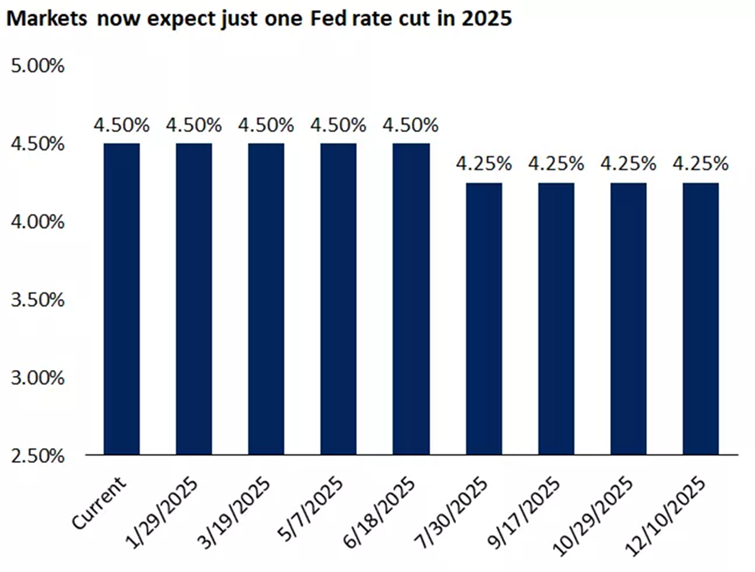

Markets Now Expect Just One Fed Rate Cut in 2025

Source: CME FedWatch Tool

In Canada, the TSX real estate sector and heavily weighted financials tumbled 1.8 per cent and technology was down 1.4 per cent. Energy was up 1.1 per cent, as the price of oil settled 3.6 per cent higher. This may have been partly as a result of the Biden administration imposing fresh sanctions targeting Russian oil and gas revenue. Consumer discretionary was the only other sector to end higher in Toronto. Investors also reduced bets that the Bank of Canada (BoC) will cut its interest rate again later this month, after a surprisingly strong Canadian jobs report. Bond yields were up sharply in the U.S. and Canada.

Canada added 90,900 jobs in December, far surpassing the forecasts for a 25,000 increase. Although that is good news for the Canadian economy, investors reduced their bets to about a 60 per cent chance that the BoC will cut rates again on January 29. This down from the 71 per cent before the data. For the full year, the amount of expected easing has been lowered to 46 basis points from 61 basis points. (4)

Last week, which was shortened due to Thursday’s market closure in honour of former U.S. President Jimmy Carter who recently passed away, U.S. equities declined. Small-cap stocks underperformed their large-cap peers for the fifth week in the past six weeks. Although the week started on a positive note, following a report that the incoming Trump administration’s proposed stance on tariffs was likely to be softer than previously indicated, optimism faded through the rest of the week after President-elect Donald Trump refuted these reports and several pieces of economic data fueled concerns about the possibility of stubborn inflation.

This fading optimism was not helped by the Federal Reserve Governor, Michelle Bowman, who noted, in a speech on Thursday, that inflation has held “uncomfortably above” the Fed’s two per cent long-term target and that while the Fed made significant progress in 2023, there are still upside risks to inflation.

Last Friday morning, the Labour Department’s closely watched monthly nonfarm payrolls report for December indicated that the U.S. economy added 256,000 jobs, which was well ahead of consensus expectations for 155,000. U.S. Treasury yields jumped following the better-than-expected jobs report, with the benchmark 10-year U.S. Treasury note yield touching its highest intraday level since November 2023 on Friday morning. Bond prices and yields, as you may know, move in opposite directions.

In Europe, the STOXX Europe 600 Index ended 0.65 higher last week, as investors continued to expect the European Central Bank (ECB) to cut interest rates in January despite an increase in inflation. Year-over-year inflation accelerated in December to 2.4 per cent, from 2.2 per cent in November, driven by higher energy prices and services costs. Despite this, other major European markets followed suit and ended up for the week.

In Japan, stock markets lost ground over the week and ended the week down, as speculation continued about the timing of the Bank of Japan’s (BoJ’s) next interest rate hike. Treasury yields were higher at the end of last week, as expectations strengthened around fewer Federal Reserve rate cuts this year.

Chinese stock markets ended down last week, as data showed that the economy remained stuck in deflation. Inflation data released on Thursday showed that China is still grappling with deflationary pressures. The consumer price index rose 0.1 per cent in December from a year earlier, which was in line with estimates and down from 0.2 per cent in November, amid lower food and fuel prices. In a statement following its quarterly policy meeting, the People’s Bank of China said that it will implement a moderately loose monetary policy in 2025 to support economic growth. It has pledged to increase financial support for the technology, emissions, pensions, and digital sectors and will reduce the reserve requirement ratio and interest rates, when appropriate, to boost consumption. (5)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

How Will the Stock Market Perform in 2025? Here's What Wall Street Thinks, Keith Speights, The Motley Fool, January 12, 2025

Strategists Bet Canada’s TSX Will Hit 28,000 Next Year as Rates Fall, Stephanie Hughes, BNN Bloomberg, December 27, 2024

The (In)Accuracy of Market Forecasts, Larry Swedroe, WealthManagement.com, August 1, 2023

Stocks end lower as blowout job data stokes inflation fears, The Globe and Mail, January 10, 2025

Global markets weekly update - U.S. labor market stronger than expected in December, T. Rowe Price, January 10, 2025

SUBSCRIBE

If you’d like to automatically receive the weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

Market Outlook 2025 - J.P. Morgan Research

2025 Global Market Outlook – Russell Investments

2025 Outlook – Royal Bank Canada Capita Markets

2025 Canada Economic Outlook: On the Mend – Bank of Montreal Capital Markets