Lexicon Financial Group Weekly Update — January 8, 2025

“I hope that in this year to come, you make mistakes. Because if you are making mistakes, then you are making new things, trying new things, learning, living, pushing yourself, changing yourself, changing your world. You’re doing things you’ve never done before, and more importantly, you’re doing something.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

Looking Around

Happy New Year!

Each year, thousands, possibly millions of people make resolutions to change something in their life. Usually it’s something they wish to correct such as eating healthier, getting more sleep, exercising more, losing weight, etc.

The cultural tradition of making resolutions dates back thousands of years. The earliest recorded instance goes all the way back to Babylonians. Over 4000 years ago when they planted their annual crops, they made promises to their gods to pay debts incurred over the previous year. This was designed to curry favour with the gods, which hopefully resulted in better crops.

Ancient Romans had similar traditions. Apparently, Julius Caesar established January 1st as the beginning of the New Year. January itself is named after the Roman god Janus, a two-faced good who simultaneously looks back into the past and forward into the future. Janus is the god of beginnings and change. Maybe he was an economist.

Of course, you don’t need a new year or any specific date on a calendar to make a change. You just need to start. But we seem conditioned to mark the passage of time with dates and milestones and so we’re left with the traditional of making resolutions around key dates.

Making resolutions or decisions about your life (or your finances, or your health) is important. But achieving those goals is often challenging. One way to enhance your ability to accomplish your objectives is to have an accountability partner. But why should you have one? Here are some reasons:

Increased Motivation: An accountability partner checks on your progress regularly and encourages you to stay on track. Today there are applications (apps) that can help, whether you are training for a 5km walk/run, learning to play a musical instrument, or improving your golf swing.

Support: Let’s face it. Sometimes our plans don’t work out. Having someone who understands and is there to support you in good times and bad means you are more likely to resume your activity if you fall off the proverbial horse.

Enhanced Discipline: When you know someone else is monitoring your progress, you're more likely to stay disciplined and follow through on your commitments.

Constructive Feedback: An accountability partner can provide valuable feedback and insights based on their own experience. This might help you identify ways that you need to adjust your strategy for maximum benefit.

Shared Success: You should celebrate your success! Sometimes, you only know how far you have come when you look back. Your accountability partner should be able to remind you of your progress.

I can hear you thinking: “Great but what does this have to do with my finances and investments?”. As it turns out, quite a lot. That’s because one way to look at your money is as a resource that allows you to do the things you want to do in your life. That may be travelling, supporting your family, or living comfortably day-to-day. Your life, your way.

And we’d be happy to be your accountability partner, if you need one. Because while we manage assets on behalf of many clients, we recognize that each person is an individual who may need some support from time to time. For example, I need help getting better at playing bass guitar. What do you need? Maybe we can help. And, if any of your resolutions are related to your personal finances – buying a house, planning a renovation, gifting to children or grandchildren, supporting a charity – know that we are here with you every step of the way.

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

TSX starts 2025 on upbeat note as resource shares climb

Wall Street ends sharply higher with assist from tech; investors eye Trump policies

Raymond James Markets & Investing: 2025 investing outlook – CIO Larry Adam, January 2, 2025

Looking Back

Source: Bloomberg

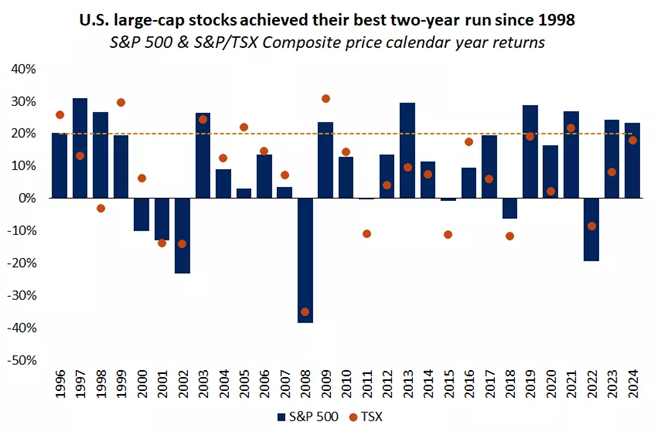

With the holidays and new year celebrations done, stock markets in the United States (U.S.) and Canada got back to business and rebounded last Friday from the underwhelming end to 2024. That said, 2024 was a good year for investors in the U.S. and Canada. Noticeably, it was the second year in a row that U.S. large-cap stocks achieved solid returns.

Last week was holiday-shortened but brought with it expectations of additional Federal Reserve rate cuts and looser regulatory policies from the incoming Trump administration which could provide momentum to markets in the coming months.

All three major U.S. stock indexes to a higher close last Friday thanks to a broad rally with mega-cap growth companies, such as Tesla and Nvidia, providing much of the impetus to the upside and putting the tech-heavy Nasdaq out front. Despite this, all three indexes posted modest declines for the week, with the S&P 500 logging its third weekly loss in four. Tech stocks were also the biggest gainers on the S&P/TSX Composite index, with nine of the 10 major sectors all posting gains. The Canadian benchmark was higher at the end of last week. (1)

Although, the pan-European STOXX Europe 600 Index ended slightly higher albeit on thin trading volume and light news flow last week, other major stock indexes ended lower. The UK’s FTSE 100 Index was the exception as it rose almost 1 per cent thanks to a weaker British pound versus the U.S. dollar which helped support the index that includes many multinational companies that generate revenue overseas. An uptick in Spain’s inflation rate appears to have supported arguments from more hawkish policymakers in the European Central Bank (ECB) for a more cautious, gradual reduction in borrowing costs. However, ECB President Christine Lagarde reiterated that that inflation in the European Union was on track to hit the 2 per cent target in 2025 which suggest that interest rates in Europe remain on a downward path.

Japan’s stock markets ended lower in a holiday-shortened week thanks to profit-taking by investors.

Chinese stock markets followed suit Chinese stocks retreated as weaker-than-expected manufacturing data hurt investor sentiment. China’s factory activity expanded for the third consecutive month but missed economists’ forecasts. The nonmanufacturing PMI, which measures construction and services activity, did better though. Separately, the Caixin China General Manufacturing PMI slowed. Taken together, this data pointed to a tentative recovery in the economy after the barrage of stimulus measures implemented by the Chinese government in September 2024. The value of new home sales by the top 100 developers stayed flat in December from a year earlier. New home sales rose 24.2 per cent month on month which added to evidence of a possible turnaround in China’s housing market after Beijing unveiled a rescue package for the ailing sector. (2)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

Stocks end sharply higher with assist from tech, Chris Wilson-Smith, Globe and Mail, January 3, 2025r

Global markets weekly update, UK home prices rise by most since 2022, T. Rowe Price, December 13, 2024

SUBSCRIBE

If you’d like to automatically receive the weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

Why does the New Year begin on January 1?