Lexicon Financial Group Weekly Update — January 22, 2025

“The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

Looking Around

Time does fly as we are almost through the first month of 2025. So far, the markets appear to have recovered from the declines in December. Some may ascribe this to the “January effect” or a tendency for increases in stock prices during the month of January. This increase in demand for stocks in January is often preceded by a decrease in price during the month of December. Below is what this effect looks like.

Source: Corporate Finance Institute

The January Effect is usually attributed to tax-loss harvesting, consumer sentiment, year-end bonuses and raising year-end report performances amongst others. It also appears to affect small-cap companies more than mid- or large-cap companies possibility due to their lower liquidity. A Salomon Smith Barney analysis of stock performance between 1972 to 2002 revealed that January tends to be a period when small companies outperform larger ones. (1)

However, phrases like "January effect" and “sell in May and go away” have dubious records as long-term investing strategies. According to Morningstar Direct data, in the past 20 years, January had the highest total return for the year in only four years - 2012, 2013, 2018, and 2019. Not bad, but not good enough to become the cornerstone of an investing strategy.

Market pundits like pithy phrases like this. In part, because it’s easy to look back and generate data to support the the claim. For example, there is some historical data that supports the adage to sell stocks in May, avoid the possibility of market decline over the summer and fall, and reinvest in November. The S&P 500 index (S&P 500) gained an average of roughly 3.0 per cent from May to October while during the winter months, it gained an average of 6.3 per cent. Except it doesn’t always work that way. Observing patterns does not necessarily mean that things will continue, because the investing landscape is continually changing. So here’s another pithy phrase: past performance is not a good predictor of future returns. If you want proof, just ask people who invested in Yahoo in 2000, when it was the largest company in the world.

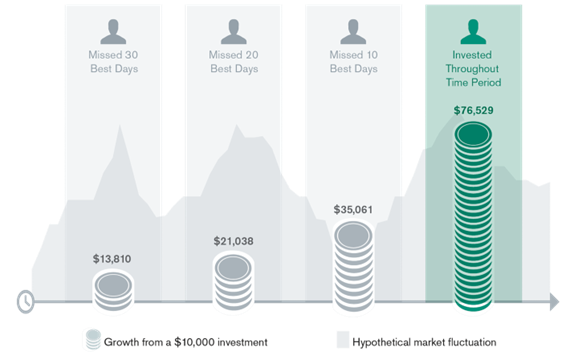

Also, trading driven by seasonal market trends is a form of market timing, and, as yet, no one has been able to consistently predict the optimal time for getting in and out of the market. For example, if you had gotten out of the market from May to October 2009, you would have missed the approximately 20 per cent increase in S&P 500. The graphic below is an illustration of this over time. (2)

Source: FactSet via American Century Investments: Growth of $10,000 in the S&P 500, 20-year data as of September 30, 2024. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

There are 11 months to go in 2025. As we have seen in the past markets can change quickly for a number of reasons. What the markets do is important but what is even more important is that you are comfortable with your financial plan and investment strategy. Our mission is to help you determine what's appropriate for your needs, so you can be ready for what lies ahead in the face of uncertainty.

We will over the next few weeks be reaching out to you to go over your investments and discuss our outlook for 2025. But remember… if you have a long-term investment strategy focusing on an arbitrary time period like a calendar makes little sense. We should focus on our own personal goals and objectives which may not align perfectly with a specific time, day, or month.

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

As Inflation Recedes, Global Economy Needs Policy Triple Pivot

ECB's Rehn says inflation confidence will allow for rate cuts

Looking Back

North American markets rallied last Friday as investors prepared for policy changes that will be ushered in by the incoming Trump administration.

The S&P 500 index and Dow Industrial Average registered their largest weekly percentage gains since November 2024 while the Nasdaq recorded its best percentage gain since early December last year. Data last week allayed fears that U.S. inflation would resurge while expectations have grown that the Federal Reserve (Fed) will bump up the timing and size of rate cuts this year. There is still some concern that moves to implement tariffs in the United States on goods imported from Canada and Mexico will be inflationary. Only time will tell, but the US government has other levers to pull to reduce the economic burden of these cuts should they wish to do so. All ten major sectors on the S&P/TSX Composite index (TSX) ended higher, led by a 1.4 per cent gain for utilities as Canadian bond yields fell. (3)

In the U.S. value stocks outperformed growth shares by the widest weekly margin since September last year. This was led in part by outperformance in the energy sector amid higher oil prices and some profit-taking in large-cap technology sector. The financials sector also posted strong weekly gains, thanks to some upside surprises to kick off the earnings season.

In terms of the U.S. economy, the highlight of the week came on Wednesday with the Labour Department’s December inflation report. Core inflation (less food and energy) rose by 0.2 per cent in December. This was slightly lower than the prior month and the smallest increase since July last year. Year-over-year core inflation also slowed, to 3.2 per cent from 3.3 per cent in November. This data does not appear to be significant enough to convince the Fed to cut rates at its upcoming January policy meeting. Although the futures markets were pricing in a near 100 per cent chance that rates will remain unchanged at the January meeting, the December numbers provide optimism that the Fed is continuing to make progress in bringing down inflation following several months of elevated readings. This keeps the door open for potential rate cuts by the later this year.

Major European stock markets also rose significantly last week higher as slower than expected inflation on both sides of the Atlantic raised hopes that central banks can keep cutting interest rates this year. The European Central Bank (ECB), according to the minutes of its December meeting, appears to be focussed on lowering interest rates cautiously and gradually. Another quarter-point reduction in the deposit rate to 2.75 per cent is expected at the end of January.

In Japan, stock markets lost ground last week as hawkish signals from Bank of Japan (BoJ) officials increased expectations that the central bank could raise interest rates at its January 23–24 monetary policy meeting. This has supported the Japanese currency, the yen, which strengthened to against the U.S. dollar weighed on the profit outlook of Japan’s export-heavy industries. Japan’s real (inflation-adjusted) wage growth, which is a key indicator of consumers’ purchasing power, fell 0.3 per cent year on year in November. This marked the fourth consecutive month of negative real wage growth. If the Japanese economy, prices and wage growth develop in line with its projections, the BoJ will raise interest rates.

Chinese equities rose as the economy improved despite persistent deflationary pressures. China’s GDP expanded a better-than-expected 5.4 percent in the fourth quarter of 2024 from a year earlier which surpassed the 4.6 per cent growth in the third quarter. Other data also showed signs of recovery. Industrial production rose an above-forecast 6.2 per cent in December from the previous year partly due to higher auto, computer, and solar cell sales. Retail sales also grew 3.7 per cent in December from a year earlier and up from a 3 per cent increase in November.

However, property investment declined deepened to 10.6 per cent year on year while the unemployment rate ticked up to 5.1 per cent. The property slump seems to be stabilizing as new home prices in 70 cities were flat in December improving from a 0.1 per cent dip in November, according to the National Bureau of Statistics. According to Bloomberg, this marked the fourth month of slower declines and comes after the Chinese government announced a slew of monetary and fiscal stimulus measures in last year’s fourth quarter that are aimed squarely at reviving the economy and putting a floor under the slumping housing sector. (4)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

January Effect - The seasonal increase in stock prices throughout the month of January, CFI Team, Corporate Finance Institute

The 'January Effect' and Stock Market Seasonality, Trey Byrd, American Century Investments, January 21, 2025

Stocks rally to close out strong week, await Trump policies, The Globe and Mail, January 17, 2025

Global markets weekly update - Core U.S. inflation eases in December, T. Rowe Price, January 17, 2025

SUBSCRIBE

If you’d like to automatically receive the weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

January Effect: What It Is in the Stock Market, Possible Causes

"Sell in May and Go Away": Definition, Statistics, and Analysis

Why Sticking to a Long-Term Investment Strategy Pays Off in Market Downturns