Lexicon Financial Group Weekly Update — September 18, 2024

“Earnings don’t move the overall market; it’s the Federal Reserve Board... focus on the central banks and focus on the movement of liquidity... most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

Looking Around

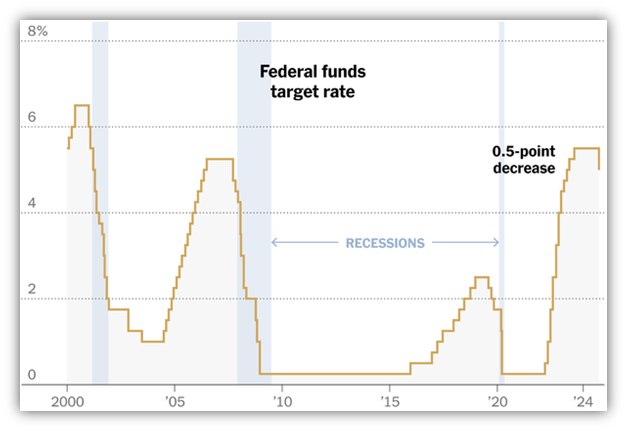

So, the United States (U.S.) Federal Reserve (Fed) finally joined other central banks and cut interest rates. In fact, it went “above and beyond” and lowered interest 50 basis points, that’s 0.5 per cent for people who like to speak language other than finance jargon.

This is the first major rate cut in some time and is a welcome relief from the COVID-inspired trend of continually raising rates. Historically, though, rate increases and cuts are part of the economic cycle. The problem is we have no accurate way of measuring how long periods of rate cuts, rate increases, or rate stability can last.

Source: The New York Times

This is the first time the Fed has cut interest rates since early 2020 and it is one of the clearest signals yet that central bankers are confident that they have inflation under control. Remember, central bank policy has been to keep target inflation at approximately two per cent per year. Raising rates removes liquidity or the supply of dollars from the economy (more money needs to be spent on servicing debt instead of buying products). Lowering rates may be inflationary, but we’ll take it at the moment. Regardless, this decision by the Fed lowers rates to about 4.9 per cent, which is down from a more than two-decade high.

This move by the Fed was a response to months of fading inflation and is meant to prevent the economy from slowing so much that it topples over into recession. Fed officials have kept a watchful eye on a recent rise in the unemployment rate and have taken out insurance against a bigger employment slowdown in the coming months. Moreover, this move is accompanied by economic projections that suggested a more aggressive pace of rate cuts than central bankers had previously predicted. As a result, the Fed is now expected to make another half point of reductions before the end of this year.

Wednesday’s rate cut marks a victory for the Fed as its officials have managed to slow inflation notably without causing major economic problems. The unemployment rate has crept up, but it has not been painful (unless you are the one unemployed). There are certainly concerns in the U.S. labour market but hiring continues and consumer spending remains strong. Economic growth in the U.S. remains robust. All of this bodes well for the Fed’s efforts to pull off a historically rare “soft landing,” where they manage to land the economy on a healthy and sustainable track without causing a recession.

Fed officials have predicted that they would cut interest rates to 4.4 per cent by the end of the year. This is much lower than the 5.1 per cent they had been expecting in June, when they last released economic estimates. And by the end of 2025, they expect to lower borrowing costs another full percentage point, to 3.4 percent. (1)

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

Video: How Fed Rate Cuts Affect the Global Economy

Video: S&P/TSX composite hits new records

What does this interest rate cut mean for other countries, central banks, investors, consumers, and, more importantly, you?

The Fed is the world's richest central bank with assets worth over $7 trillion (according to the Sovereign Wealth Fund Institute). Its power and influence stem from the stature of the U.S. economy, which is still the largest globally. As a result, its decisions can impact foreign exchange markets. Despite what cryptocurrency enthusiasts will say, the U.S. dollars still remains the most used currency in the world. If interest rates are changing in the U.S., the cost of borrowing for many countries, especially in emerging markets, will change as well, as they tend to borrow U.S. dollars. (2)

For investors, interest rate cuts benefit both bondholders and stockholders. Bondholders will see a rise in bond prices as lower interest rates make their existing bonds more valuable. If an investor has a 10-year bond paying six per cent interest, and new bonds are now offering only 5.5 per cent interest, your bond becomes more valuable because it pays more. This means this bond can be sold for more in the open market at a premium.

Given the rate cuts in Canada and the U.S., those who are looking to refinance or are wanting to buy a home will see mortgage rates eventually fall. This will make buying a home or refinancing more affordable in the coming months. These rates are unlikely to hit the lows we have seen in the past but could boost the supply of homes as homeowners may become more willing to sell.

Lower interest rates typically encourage spending and investment, giving the economy a short-term boost. Businesses may take out loans to expand, which can create jobs and increase consumer spending. The risk here is that if rates fall too low (as it did in the past) for too long, like a phoenix rising from the ashes, inflation comes back to erode purchasing power. Hopefully, consumers have learned not to take on excessive debt due to cheap borrowing, or we might just find ourselves in the same position at some point in the future. (3)

Looking Back

U.S. stock markets rose to close out their best week of the year as markets anticipated the rate cut. These hopes were fully met by the Fed this week. Canada's main stock index, the S&P/TSX composite (TSX) index, rose to an all-time high on Friday in a broad-based rally that was led by mining stocks and fueled by expectations of the same big rate cut. The TSX’s materials sector, which includes fertilizer companies and metal mining shares, rose 1.5 per cent as gold and copper prices climbed, closed at its highest level since April 2022. The tech sector added 0.7 per cent while the real estate sector, which could particularly benefit from lower borrowing costs, ended 2.1 per cent higher. (4)

Across the pond in Europe, markets rose across the board thanks to an interest rate cut from the European Central Bank (ECB). The ECB has now lowered its deposit rate for a second time this year amid signs of weakening economic growth and slowing inflation in the eurozone.

In Japan, markets ended the week mixed as Japan’s exporters continued to face currency headwinds, as the yen strengthened against the U.S. dollar and the continued hawkish outlook on the Bank of Japan’s (BoJ’s) monetary policy.

Equity markets in China declined last week as weak inflation data spurred concerns about a downward price-wage spiral weighing on the economy. The latest data spurred calls for the Chinese government to roll out more forceful measures to halt a negative cycle of falling corporate revenue, wages, and spending, which many analysts and economists believe threatens China’s longer-term growth. (5)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

What to know about a consequential Fed meeting, Jeanna Smialek, The New York Times, September 18, 2024

How Fed rate cuts affect the global economy, Carlos Waters, CNBC, September 18, 2024

Winners And Losers from The Fed’s Interest Rate Decision, Natalie Campisi, Forbes Advisor, September 19, 2024

TSX posts biggest weekly gain in 11 months on Fed optimism, Fergal Smith, Reuters, September 13, 2024

Global Markets Weekly Update, T. Rowe Price, September 13, 2024

SUBSCRIBE

If you’d like to automatically receive the weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below: