Lexicon Financial Group Weekly Update — May 22, 2024

“For me, geopolitical issues are becoming more important, because how can you understand economy if you don’t understand geopolitics? People think economists just deal with spreadsheets and charts. That’s a narrow-minded caricature.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

Looking Around

Well, despite recent reduction in global food prices, the inflationary impact still lingers, particularly in many developing countries. Many low- and middle-income economies are still trapped in the food crisis precipitated by the high costs of food.

One reason for food price increase can be traced back to the conflict in Ukraine. It’s long been seen as the “breadbasket of Europe,” and is a significant global exporter of agricultural commodities, including grains and sunflower oil. As a result, the continuing conflict in one of the most fertile countries in the world has ensured that the pain of the fighting extends far beyond Ukraine’s borders. (1)

As the second-largest oil producer and natural gas exporter, Russia’s war with Ukraine has severely impacted the energy market. From October 1, 2021, to August 25, 2022, the war and its chain events caused the West Texas Intermediate (WTI) crude oil prices to increase by $37.14 (a 52.33 per cent surge), and the Brent crude oil price to rise by $41.49 (a 56.33 per cent spike).

As an aside, unless you are an energy trader, you may not know the difference between these two terms. Brent crude comes from the North Sea and WTI (as the name implies) comes from the U.S. (notably, Texas, but also North Dakota and Louisiana). No oil is the same, and the ability to get it to market has an impact on price. For example, Brent comes largely from ocean deposits which makes it easy to transport by ship. WTI comes from, well, the centre of a continent, so transporting it is more costly. But we digress.

During this time period, the Russia–Ukraine war accounted for 70.72 per cent and 73.62 per cent of the fluctuation in WTI and Brent crude oil prices, respectively. The war also intensified oil price volatility and fundamentally altered the trend of crude oil prices. (2)

This is typical of what is known as a geopolitical event.

Geopolitical events usually occur at the intersection of geographical factors (natural resource access, proximity to countries in turmoil, etc.), policy decisions (limits to foreign direct investment, tolerance of corrupt elites, etc.) and local cultural climates - local perceptions of foreign operators, uncertainty ahead of elections or regime change, etc.

It's easy to see a regional conflict as a geopolitical event, but other large scale events – think natural disasters – can also play havoc with financial markets as supply chains, financing arrangements and workforces are disrupted or displaced. Some refer to these as “black swan” events – rare, but they do happen from time to time.

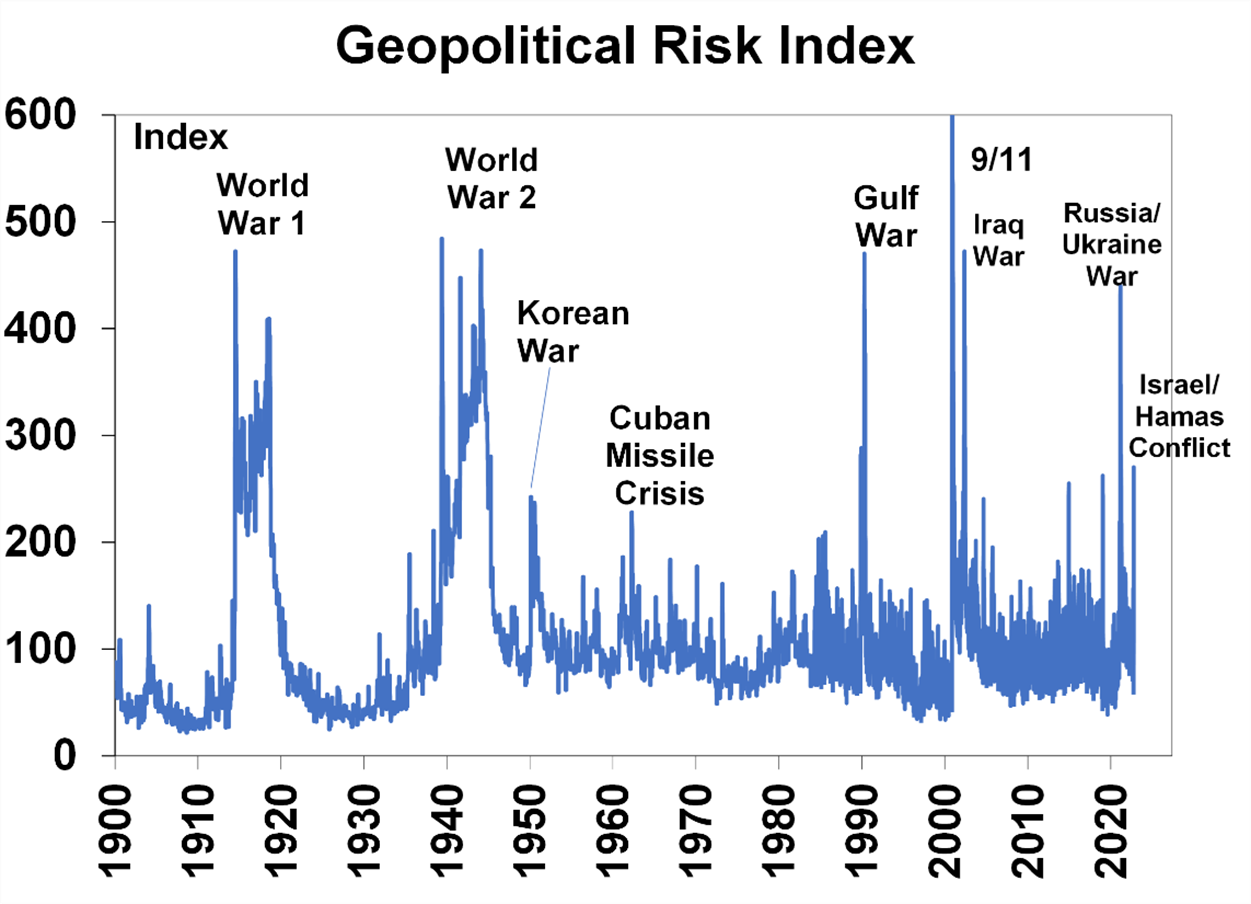

One way to measure changes in geopolitical events is through a “Geopolitical Risk Index,” which was constructed by Dario Caldara and Matteo Iacoviello, based on a tally of newspaper articles since 1900. The chart below highlights the changes in the long-term index. This index is viewed as a simultaneous indicator of rising or falling geopolitical risks, rather than a leading indicator of when tensions will erupt.

Source: https://www.matteoiacoviello.com/gpr.htm, AMP

The potential impacts of geopolitics on economies and markets are numerous. Direct impacts can occur through a loss to consumer and business confidence in the countries impacted, which flows through to spending, investment and GDP growth. In the case of war, the destruction of buildings and infrastructure has a large negative effect on growth, but the eventual rebuilding often causes a lift to GDP growth down the track. Countries that trade with affected countries are also impacted through the changes to import and export flows. Commodity prices are also impacted by geopolitical events due to supply issues. Financial markets also respond to geopolitical risks, usually via the equity markets in directly affected countries and those in major economies due to the negative impact on confidence. Currencies of impacted countries can often experience a depreciation in response to events as investor uncertainty rises. (3)

We closely monitor geopolitical events and their potential impact on markets and the areas in which we invest. If we don’t understand what is happening at a global level, it makes it more challenging to properly diversify an investment portfolio.

Looking Back

The S&P/TSX Composite Index, Canada’s main stock index, managed to end slightly higher last week, as investors cheered corporate earnings, including from Canada Goose, whose shares surged 15.5 per cent, as the luxury apparel group beat Wall Street estimates for fourth-quarter results, riding on a recovery in North America and steady demand in China for its pricey puffer jackets. Heavily-weighted financials added 0.1 per cent and utilities was up 0.4 per cent. The materials sector was a drag, falling 0.2 per cent, as gold and copper prices fell. The energy sector ended nearly unchanged as oil settled 0.8 per cent higher at US$79.23 a barrel. (4)

Weekly North American Market Statistics

| Index | Week's Change | Year to Date |

| S&P 500 | 1.5% | 11.2% |

| Nasdaq Composite | 2.1% | 11.2% |

| Dow Jones Industrial Average | 1.2% | 6.1% |

| S&P/TSX Composite Index | 0.7% | 7.1% |

Source: Associated Press 05/17/2024 and Morningstar Direct 05/16/2024

The Dow Jones Industrial Average, S&P 500 Index, and Nasdaq Composite all ended higher last week, with the Dow crossing the 40,000 threshold for the first time. Thanks to inflation and interest rate worries appearing to dissipate, growth stocks outperformed. All of this is partly due to the lower implied discount placed on future earnings.

Source: Bloomberg. Dow Jones Industrial Average Index

The major factor supporting positive investor sentiment appeared to be last Wednesday’s release of the Labour Department’s April consumer price index (CPI), which came in at or modestly below expectations, in contrast to hotter-than-expected prints over the preceding three months. Headline prices rose 0.3 per cent in April, slightly below expectations, while core (less food and energy) prices rose 0.3 per cent in line with expectations. Inflation remained concentrated in services prices, especially transportation services costs, which rose 0.9 per cent over the month and 11.2 per cent over the past year.

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

Geopolitics Is Biggest Market Risk in 2024, Investor Poll Shows - Bloomberg

Thursday’s retail sales figure also appeared to impress investors—if through the lens of bad news for the economy being treated as good news for stocks and inflation. The Commerce Department reported that retail sales were flat in April versus consensus estimates of a 0.4 per cent gain, while downwardly revising its estimate of March sales lower, from +0.7 per cent to +0.6 per cent. This data included some evidence that consumers were pulling back on discretionary spending, with sales at non-store (mostly online) retailers falling 1.2 per cent, while sales at restaurants and bars continued to moderate—and even fell slightly when taking account of higher prices (retail sales data are not adjusted for inflation).

In local currency terms, the pan-European STOXX Europe 600 Index rose 0.42 per cent but slipped from the record-high it achieved during the week. Cautious comments from European Central Bank (ECB) members also appeared to cool investor optimism about how much monetary policy might ease this year. Major stock indexes were mixed. Germany’s DAX fell 0.36 per cent, while France’s CAC 40 Index declined 0.63 per cent. Italy’s FTSE MIB advanced 2.14 per cent. In the U.K., the FTSE 100 Index finished modestly lower.

Japanese equity markets finished the week higher, with the Nikkei 225 Index gaining 1.5 per cent and the broader TOPIX Index up 0.6 per cent. This was despite a backdrop of economic weakness and a range-bound yen on expectations of U.S. interest rate cuts and the tentative hawkishness on the part of the Bank of Japan (BoJ).

Chinese equity markets were little changed after the central government unveiled a historic rescue package to stabilize the country’s ailing property sector last Friday. The Shanghai Composite Index was broadly flat, while the blue chip CSI 300 added 0.32 per cent. In Hong Kong, the benchmark Hang Seng Index gained 3.11 per cent. (5)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

Update: how is the war in Ukraine affecting global food prices, Lotanna Emediegwu, Economics Observatory, February 23, 2024

The impact of Russia–Ukraine war on crude oil prices: an EMC framework, Qi Zhang, Yi Hu, Jianbin Jiao & Shouyang Wang, Humanities and Social Sciences Communications, January 2, 2024

Econosights - The impact of geopolitics on economies and financial markets, Diana Mousina, Deputy Chief Economist, AMP, Oct 23, 2023

The close: Dow briefly hits 40,000 milestone, TSX rises on upbeat earnings, The Globe and Mail, May 16, 2024

Global Markets Weekly Update, T. Rowe Price, May 17, 2024

SUBSCRIBE

If you’d like to automatically receive the weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

Video and Article: Geopolitics and its Impact on Global Trade and the Dollar

How are geopolitical risks affecting the world economy?

What rising geopolitical tensions could mean for the markets and economy