Lexicon Financial Group Weekly Update — March 5, 2025

“Wall Street, in the main, hates uncertainty, which manifests itself in depressed share prices of companies whose prospects lack ‘visibility.’ But where the market can err is in confusing uncertainty with risk.”

From the desk of Craig Swistun, CIM, MFA-P, Portfolio Manager, Raymond James Investment Counsel, and Wayne Hendry, Client Relationship Manager, Raymond James Investment Counsel

Looking Around

We don’t want to speak for everyone, but juggling the tariffs-on, tariffs-off, tariffs-back-on, and maybe-tariffs-will-be-cancelled balls is getting a bit frustrating. And the markets seem to agree. Up, down, up, down. We’re all getting tired!

President Donald Trump kick-started the implementation of United States (U.S.) tariffs this week. For now, Canada, Mexico and China are being targeted but other countries will be subject to U.S. tariffs in the near future, as President Trump is, in his own words, just getting started.

To better understand the current situation, let’s take a walk down memory lane. Between 1798 and 1913, tariffs were a major source of U.S. government revenue. They accounted for anywhere from 50 per cent to 90 per cent of federal income. (If you want to learn more about the history of U.S. tariffs and how this was achieved, please read the articles in our “Looking to Learn?” section.)

But, over the last 70 years, tariffs have rarely contributed more than two per cent of U.S. federal revenue. In 2024, U.S. Customs and Border Protection collected $77 billion in tariffs or about 1.57 per cent of total government revenue. Since the 1930s, the U.S. has moved away from protectionism in favour of trade liberalization. Tariffs, as a policy tool under President Trump, isn’t just a change in policy, it’s a radical shift. And, although it’s true that the U.S. has more leverage than most countries because many economies depend on access to the U.S. market, tariffs come with consequences. China has retaliated, imposing its own tariffs on U.S. goods. These include a 15 per cent duty on coal and liquefied natural gas (LNG), as well as 10 per cent tariffs on agricultural machinery, crude oil and some vehicles. The Chinese government has also launched an antitrust investigation into Google—likely as a form of economic retribution. (1)

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy aimed at protecting American industry and reducing reliance on foreign imports. The McKinley Tariff Act of 1890 raised import duties to an average of 50 per cent - one of the highest levels in U.S. history. The logic here was simple: If foreign goods were more expensive, Americans would buy domestic products, fueling economic expansion. Instead of strengthening America’s trade position, the tariff triggered retaliation from other nations. Prices rose, particularly for middle- and lower-income Americans, and political backlash followed. In the 1890 midterm elections, voters revolted: McKinley lost his seat, and Democrats took control of the House. At the time, some Republicans dreamed of annexing Canada, believing that the economic pressure would push Canadians to seek statehood. The tariff, however, had the opposite effect —Canadians rallied against what they saw as economic coercion and deepened its ties with the British Empire, reinforcing the very trade barriers the U.S. sought to disrupt. (2)

So where are we right now? Things are uncertain. Markets generally dislike uncertainty. We expect more market volatility, going forward. We’re making adjustments as needed, but if you have any questions or concerns, let’s jump on a call and talk it through.

Read and Watch

Want deeper insight into topics in your Weekly Update? Then, read and/or right click:

The (Not So) Magnificent Seven?

The trade war is here. You'll notice it at the grocery store first

What is the impact of tariffs on the U.S. economy?

BOJ vows to keep raising rates despite Trump tariff risks

Falling prices signal bigger troubles ahead for China’s economy

Looking Back

Before looking at what happened in the markets last week, let us take stock of what has happened so far this week. It has been a roller coaster ride for major markets globally as tariffs were implemented by the U.S. on Canada, Mexico and China. There is more to come in terms of tariffs not only from these countries but others who will soon have tariffs placed on their goods that are exported to the U.S. And let’s not forget that there could be tariffs on the European Union (E.U) and other countries across the world. It is worth remembering again that, historically, markets recover from shocks like tariffs, pandemic, geopolitical events, etc. and go on to do better over the long term.

That said, U.S. and Canadian stocks ended higher last Friday, after a meeting between the U.S. President Donald Trump and Ukrainian counterpart Volodymyr Zelenskyy ended in shambles. The S&P/TSX composite (TSX) index ended last week up 1.1 per cent. However, for the month, it was down 0.6 per cent, as investors grappled with the threat of hefty U.S. tariffs on Canadian goods. Although the TSX is expected to reach a new record high by the end of 2025, thanks to lower borrowing costs, an uncertain outlook for global trade could limit gains and potentially trigger a correction. (3)

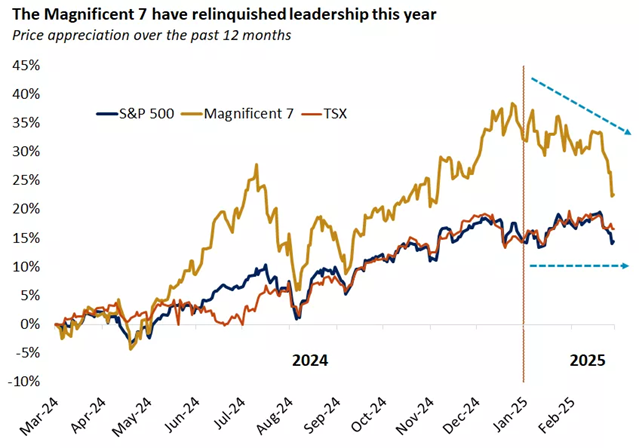

U.S. growth stocks significantly underperformed last week, and the Nasdaq Composite recorded its worst weekly drop since early September last year, as tech stocks, particularly the Magnificent Seven, declined amid ongoing regulatory uncertainty and concerns that the multi-year artificial intelligence-fueled rally could be losing steam.

Source: Bloomberg

Tariff and inflation fears also continued to be a drag on equities. The U.S. Labor Department released its core personal consumption expenditures (PCE) price index last Friday. This index is the preferred inflation gauge for the Federal reserve (Fed), and it showed prices rising by 0.3 per cent in January, in line with expectations. On a year-over-year basis, prices rose 2.6 per cent, down from December’s reading of 2.9 per cent. This is still above the Fed’s long-term target of two per cent. On top of this, the Conference Board reported its February Consumer Confidence Index last Tuesday—it fell seven points to 98.3 which is the steepest monthly drop since August 2021. Markedly, the expectations portion of the index—which gauges consumers’ short-term outlook for income, business, and labour market conditions—dropped below 80 for the first time since June 2024. Readings below 80 can be indicative of a recession ahead. The report also noted that average 12-month inflation expectations rose sharply in February from 5.2 per cent to 6 per cent.

While major stock markets in Europe ended mixed last week, the pan-European STOXX Europe 600 Index ended 0.60 per cent higher, posting its longest streak of weekly gains since August 2012. Preliminary data from Germany, France, and Italy for February painted a mixed picture for inflation. This could support the European Central Bank’s (ECB) contention that although inflation was heading back to two per cent, there was some evidence suggesting a shift in the balance of risks to the upside since December last year.

Japan’s stock markets retreated last week. Domestic chip- and artificial intelligence-related stocks led the declines amid a sell-off in the U.S. technology space. Investor concerns also increased about how an escalation of tariffs by the U.S. could impact the outlook for Japan’s economy and the path of further monetary policy normalization by the Bank of Japan (BoJ). The BoJ remains in monetary tightening mode, thanks to high headline inflation and strong wage growth. In fact, the BoJ is expected to raise interest rates again this year.

Mainland Chinese stock markets ended down last week, after the U.S. ratcheted up measures targeting China’s economy. Most of the week’s declines occurred last Friday, a day after President Trump announced an additional 10 per cent levy on Chinese imports along with 25 per cent tariffs on Canada and Mexico. In response, China stated that it will counter with all necessary measures to defend its legitimate rights and interests. The latest tariff threat came days after the Trump administration issued a memo instructing the Committee on Foreign Investment in the U.S. (CFIU.S.) to curb Chinese spending on strategic sectors like technology and energy. Many analysts see this as further proof of a decoupling between the world’s two largest economies.

China’s Two Sessions, which refer to the concurrent meetings of the Chinese People’s Political Consultative Conference and the National People’s Congress, began this week and will end around March 11. This is an annual political event in which China unveils its economic priorities and targets for the coming year. It is expected that China will likely maintain a gross domestic product growth target of around five per cent for the third straight year. Analysts also expect China to reveal a fiscal deficit ratio of four per cent of GDP, which is a record high target, and a consumer inflation target of around two per cent, which is down from the previous year’s three per cent, reflecting deflationary pressures on the economy. (4)

The opinions expressed are those of Craig Swistun and not necessarily those of Raymond James Investment Counsel which is a subsidiary of Raymond James Ltd. Statistics and factual data and other information presented are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Raymond James advisors are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters.

The Surprising History of Tariffs And Their Role in U.S. Economic Policy, Frank Holmes, U.S. Global Investors, February 10, 2025

Trade Wars Come with a Price, And Investors May Already Paying It, Frank Holmes, U.S. Global Investors, March 3, 2025

Heated Trump-Zelensky Oval Office showdown leaves investors rattled, The Globe And Mail, February 28, 2025

Global markets weekly update – U.S. consumer confidence falls by most since August 2021, T. Rowe Price, February 28, 2025

SUBSCRIBE

If you’d like to automatically receive the weekly Market Update by email, enter your email address in the box below.

We respect your privacy, and you can always remove yourself from the mailing at any time.

Looking to Learn?

If you want to know more about some of the topics we wrote about this week, just click on the links below:

Before Trump: The long US history of tariff wars with Canada and the world

President McKinley’s Tariff Mishap Could Be A Warning Sign for Trump’s Trade War

Trump's tariffs on Canada, China and Mexico draw quick retaliation, as Trudeau calls them a "dumb thing to do"